- To return to Home

- To return to Investor Relations

- To return to ICO's Overview

- To return to Key Figures and Activity Indicators

Key Figures and Activity Indicators

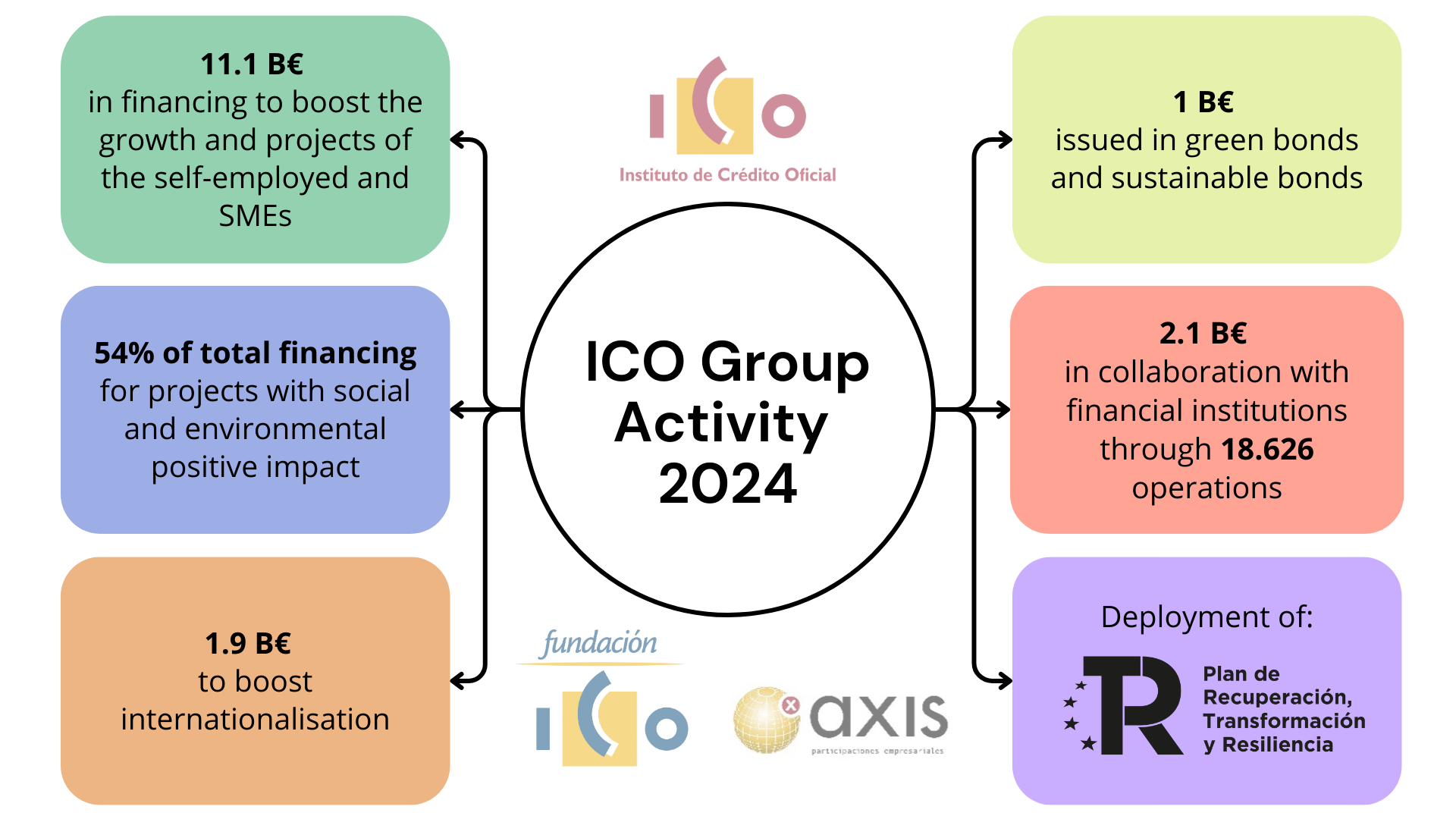

Instituto de Crédito Oficial (ICO), through its activity in 2024, has contributed to channelling more than 11.1 billion euros in financing to the self-employed, SMEs and companie

Instituto de Crédito Oficial (ICO), through its activity, has contributed to channelling more than 11.1 billion euros in financing to the self-employed, SMEs and companies to promote their growth and the development of their projects by 2024.

This figure keeps ICO activity at levels similar to those recorded in 2023.

As a national promotional bank, ICO offers Spanish companies a wide range of financing products, which it divides into two large blocks: ICO Mediation Lines and Direct Financing programmes.

ICO Mediation Lines are designed to make ICO resources accessible to the self-employed and SMEs in all Autonomous Communities and sectors of activity. To this end, the collaboration of financial institutions, which are responsible for marketing these products, is essential, providing them with a high degree of capillarity. Thanks to this public-private partnership scheme, more than 2.1 billion euros in financing was channelled through 18,626 transactions in 2024. In 2024, 54% more loans were signed with this financial instrument than in the previous year.

In the area of direct financing, ICO has approved operations amounting to 6.5 billion euros, 14% more than in 2023, to promote projects developed by medium and large companies, paying special attention to those that generate a positive social and/or environmental impact.

In direct financing programmes, ICO has continued to work so that companies can diversify the sources where they tap into resources, offering different solutions linked to the acquisition of project bonds or corporate bonds and promissory notes issued by Spanish companies in regulated markets such as the MARF, prioritising those that are certified as responsible issuers or that are listed in sustainability indices. In total, ICO has invested 1.5 billion euros in these programmes.

Boosting the internationalisation of businesses

In its financing activity, ICO promotes the international activity of Spanish companies and actively contributes to the Strategy for the Internationalisation of the Spanish Economy 2021-2027.

Of the total loan volume listed under the Mediation Facilities and direct financing programmes, 1.9 billion euros was allocated to internationalisation projects (42% more than in 2023).

Also noteworthy is the increase in the Canal Internacional programme. This line supports and promotes the financing and activity of Spanish companies with an international presence through the operating scheme of the well-known ICO Mediation Lines to multilateral banks, national promotional banks or subsidiaries of Spanish banks in other countries. ICO funds these entities, with which it signs collaboration agreements, and the latter channel the funds to Spanish companies and projects in the countries in which they operate, in such a way that the entities' know-how on the market in which the Spanish company is going to work is incorporated, while at the same time facilitating access to financing in local currency.

With Canal Internacional, ICO has mobilised 921 million in financing in 2024 for companies and projects with Spanish interest located mainly in LATAM. The volume of financing is 234% higher than in the previous year.

In addition, ICO manages, on behalf of the Secretary of State for Trade, the internationalisation support instruments -FIEM and CARI- with which operations amounting to 690 million euros have been formalised.

Guarantee Lines on behalf of the State

On behalf of the State, ICO manages various government-approved guarantee programmes that enable companies to access financing under the best conditions in scenarios of exceptional uncertainty.

In November, ICO, in collaboration with financial institutions, activated the Guarantee Line aimed at households and businesses in the municipalities affected by DANA that struck on 29 October. This programme was designed with a dual objective: first, to enable financial institutions to advance compensation and aid to individuals and businesses, and second, to enable businesses to access financing under the best possible conditions to recover their productive capacity. In 2024, work has been done to deploy two sections of this Line totalling 1.3 billion in guarantees.

In addition, ICO continued to manage the Ukraine Guarantee Line, set up by the government to channel financing to companies that are affected by the economic effects of the war in Ukraine, such as the increase in energy, raw materials and electricity prices. This line was valid until 30 June for most sectors, and was extended for the agriculture, livestock and aquaculture sectors until December.

The Ukraine Guarantee Line, in collaboration with financial institutions, has mobilised 7.8 billion euros in financing for more than 37,300 operations, 96% of which correspond to SMEs and the self-employed.

Recovery, Transformation and Resilience Plan

ICO contributes with its know-how and capacity to generate new products, together with the relevant ministries and agencies, to the deployment of initiatives included in the Recovery, Transformation and Resilience Plan.

The approval of the Addendum to the Recovery Plan (PRTR) by the European Commission in October 2023 marked a new milestone in the activity of ICO Group, which has been assigned the management of different programmes.

During 2024, agreements were signed with the Ministry of Economy, Trade, and Business to activate the Green and Business and Entrepreneurship Facilities, and with the Ministry of Housing and Urban Agenda to activate the ICO Vivienda programme. With these programmes ICO is managing more than 34 billion euros in Recovery Plan loans, financed with Next Generation EU funds.

Resources are being channelled in public-private partnership through ICO Mediation Lines and ICO direct financing products.

In addition, AXIS - the ICO Group's venture capital manager - launched in May 2024 a call for proposals to select funds to channel EUR 900 million from the PRTR in collaboration with private fund managers. This call was awarded in January 2025.

Financing of sustainable projects

As one of its strategic pillars, ICO continued working to strengthen its role as a promoter of sustainable projects, both socially and environmentally, in accordance with its 2022-2027 Strategy, aligned with the Recovery, Transformation and Resilience Plan, which establishes that 40% of all new financing during the reference period must be sustainable.

Of the total direct financing operations approved by ICO in 2024, 54%, some 3.5 billion euros that will mobilise an investment of 25.1 billion euros, finance projects with a positive environmental or social impact. The largest volume of approved financing is focused on supporting the fight against climate change, specifically in the renewable energy and sustainable mobility sectors.

As an accredited entity for channelling EU funds (Implementing Partner), ICO launched in 2024 the "ICO Fondos Sociales Invest EU" call, within the Invest EU programme. With this new financial instrument, it will invest 268 million euros in capital funds specialized in promoting social and affordable rental housing projects.

ICO has also played an active role in the Alternative Fuels Infrastructure Facility (AFIF), channelling 118 million euros (grant+financing) for seven alternative fuel infrastructure projects.

AXIS also strengthened its sustainability efforts during the year, having approved sustainable investments of more than 1 billion euros.

Benchmark issuer of green bonds and social bonds

ICO issues bonds in the capital markets to carry out its corporate financing activity. In 2024, ICO raised medium and long-term funds amounting to 11.1 billion euros.

The highlight of the exercise was the two public transactions in sustainable format. Specifically, ICO launched its eleventh social bond issue and its sixth green bond, each worth 500 million euros. With the two transactions carried out in 2024, the volume of sustainable debt issued by ICO stands at 8.6 billion euros in 17 transactions (11 social and 6 green).

The funds raised through these 17 sustainable operations fund projects that have a positive social and environmental impact. ICO social bonds have financed 73,097 projects for self-employed workers, SMEs, and large companies, which in turn have generated or maintained more than 478,000 jobs and the construction of social infrastructure such as hospitals and housing.

With the issuance of green bonds to date, ICO has promoted 44 renewable energy and clean transport projects by Spanish companies, which have mobilised an investment of approximately 18.9 billion euros and will prevent the emission of more than 1,250,000 tonnes of CO2 per year.

| 2023-2024 ICO FUNDING TO COMPANIES (provisions) | |||||||

|---|---|---|---|---|---|---|---|

| 31/12/2023 | 31/12/2024 | 2023+2024 | |||||

| Amount(M€) | Transactions | Amount(M€) | Transactions | Amount(M€) | Transactions | ||

| Total: ICO SECOND FLOOR FACILITIES + DIRECT LENDING |

7,530 | 12,715 | 7,207 | 19,212 | 14,737 | 31,927 | |

| National | 6,174 | 11,809 | 5,285 | 18,455 | 11,459 | 30,264 | |

| International | 1,357 | 906 | 1,522 | 757 | 3,278 | 1,663 | |

| TOTAL ICO SECOND FLOOR FACILITIES | 2,521 | 12,115 | 3,050 | 18,695 | 5,571 | 30,810 | |

| Total National ICO Second Floor Facilities | 2,105 | 11,250 | 2,034 | 17,976 | 4,139 | 29,226 | |

| Total International ICO Second Floor Facilities | 416 | 865 | 1,016 | 719 | 1,432 | 1,584 | |

| TOTAL DIRECT LENDING | 5,009 | 600 | 4,157 | 517 | 9,166 | 1,117 | |

| Total National Direct Lending | 4,069 | 559 | 3,251 | 479 | 7,320 | 1,038 | |

| Loans/corporate bonds | 4,048 | 557 | 3,092 | 474 | 7,140 | 1,031 | |

| Guarantees | 21 | 2 | 159 | 5 | 180 | 7 | |

| Total International Direct Lending | 940 | 41 | 906 | 38 | 1,846 | 79 | |

| Loans/corporate bonds | 802 | 34 | 723 | 27 | 1,525 | 61 | |

| Guarantees | 138 | 7 | 182 | 11 | 321 | 18 | |

| LENDING ACTIVITY AND MAIN MAGNITUDES | ||

|---|---|---|

| 2023 (M€) | 2024 (M€) | |

| Lending Activity | 20,847 | 22,498 |

| ICO Second Floor Facilities | 6,807 | 7,865 |

| Direct Lending | 14,039 | 14,633 |

| Direct Loans | 12,476 | 12,680 |

| Corporate bonds | 1,155 | 1,668 |

| Pagares MARF | 409 | 285 |

| Guarantees* | 554 | 750 |

| Financial and other activities | 10,810 | 15,282 |

| TOTAL BALANCE | 31,657 | 37,780 |

| Financial debt | 23,060 | 29,726 |

| Other liabilities | 2,907 | 2,670 |

| Equity | 5,689 | 5,385 |

| RESULTS ACCOUNT (M€) | 2023 | 2024 |

|---|---|---|

| Interest margin | 290.2 | 254.6 |

| Gross margin | 361.5 | 358.2 |

| Result for the year | 240.2 | 239.8 |

| RATIOS | 2023 | 2024 |

|---|---|---|

| Solvency** | 26.48 | 22.99 |

| NPL ratio | 4.20 | 4.03 |

| Coverage | 128.25 | 142,01 |

* Granted guarantees not included on balance sheet.

** ICO's own resources are of the highest quality (Capital and reserves organically generated).

| 30/09/2025 ICO FUNDING TO COMPANIES (approvals) | |||

|---|---|---|---|

| 30/09/2025 | |||

| Amount(M€) | Transactions | ||

| Total: ICO SECOND FLOOR FACILITIES + DIRECT LENDING |

6,719 | 5.321 | |

| National | 4,152 | 5,122 | |

| International | 2,567 | 199 | |

| TOTAL ICO SECOND FLOOR FACILITIES | 1,357 | 4,950 | |

| Total National ICO Second Floor Facilities | 451 | 4,775 | |

| Total International ICO Second Floor Facilities | 905 | 175 | |

| TOTAL DIRECT LENDING | 5,363 | 371 | |

| Total National Direct Lending | 3,232 | 338 | |

| Loans/Corporate bonds/Commercial paper MARF/ | 3,160 | 335 | |

| Guarantees | 72 | 3 | |

| Total International Direct Lending | 1,662 | 24 | |

| Loans/Corporate bonds | 941 | 13 | |

| Guarantees | 721 | 11 | |

| Total equity investments | 469 | 9 | |

| LENDING ACTIVITY AND MAIN MAGNITUDES | ||

|---|---|---|

| 30/09/2025 (M€) | ||

| Lending Activity | 23,229 | |

| ICO Second Floor Facilities Loans | 7,192 | |

| Direct Lending | 16,037 | |

| Direct loans | 13,331 | |

| Corporate bonds | 2.349 | |

| Commercial paper MARF | 358 | |

| Guarantees* | 1,034 | |

| Financial and other activities | 20,649 | |

| TOTAL BALANCE | 43,878 | |

| Financial debt | 34,892 | |

| Other liabilities | 2,887 | |

| Equity | 6,100 | |

| RESULTS ACCOUNT (M€) | 30/09/2025 |

|---|---|

| Interest margin | 208.6 |

| Gross margin | 264.8 |

| Result for the year | 189.7 |

| RATIOS | 30/09/2025 |

|---|---|

| Solvency** | 23.61 |

| NPL ratio | 3.43 |

| Coverage | 144.85 |

* Granted guarantees not included on balance sheet.

** Provisional 2025 data pending reporting to the BdE. ICO's own resources are of the highest quality (own generation capital and reserves).