ICOBuilding the future together

Latest news portal ICO

-

Our priorities

ICO Group promotes sustainability as one of the bases of its corporate strategy

-

ICO Green & Social Bonds

ICO has consolidated its role as one of the key players in the European ESG market

-

Sustainability

Promoting sustainability in its three dimensions: environmental, social and governance (ESG)

Key figures

-

14,737 M€financing facilities 2023 -2024

-

9,050 M €social and green bonds

-

3,278 M€internationalization 2023-2024

-

6,339 M€sustainable projects 2023-2024

ICO Group

ICO Group is made up of the Instituto de Crédito Oficial, Axis - its venture capital subsidiary - and ICO Foundation.

-

Instituto de Crédito Oficial

ICO is a corporate state-owned entity attached to the Ministry of Economic Affairs and Digital Transformation. It has become a reference point for financing both SMEs and large investment projects, helping to boost sustainable economic growth

-

AXIS

The venture/private capital manager wholly owned by Instituto de Crédito Oficial (ICO).

It is focused on promoting the growth, development and internationalisation of Spanish companies through equity and quasi-equity instruments -

ICO Foundation

Since its creation in 1993, its mission has been to contribute to and support the development of society through the promotion of culture and knowledge, with an international vocation and on two axes: the economy and contemporary art.

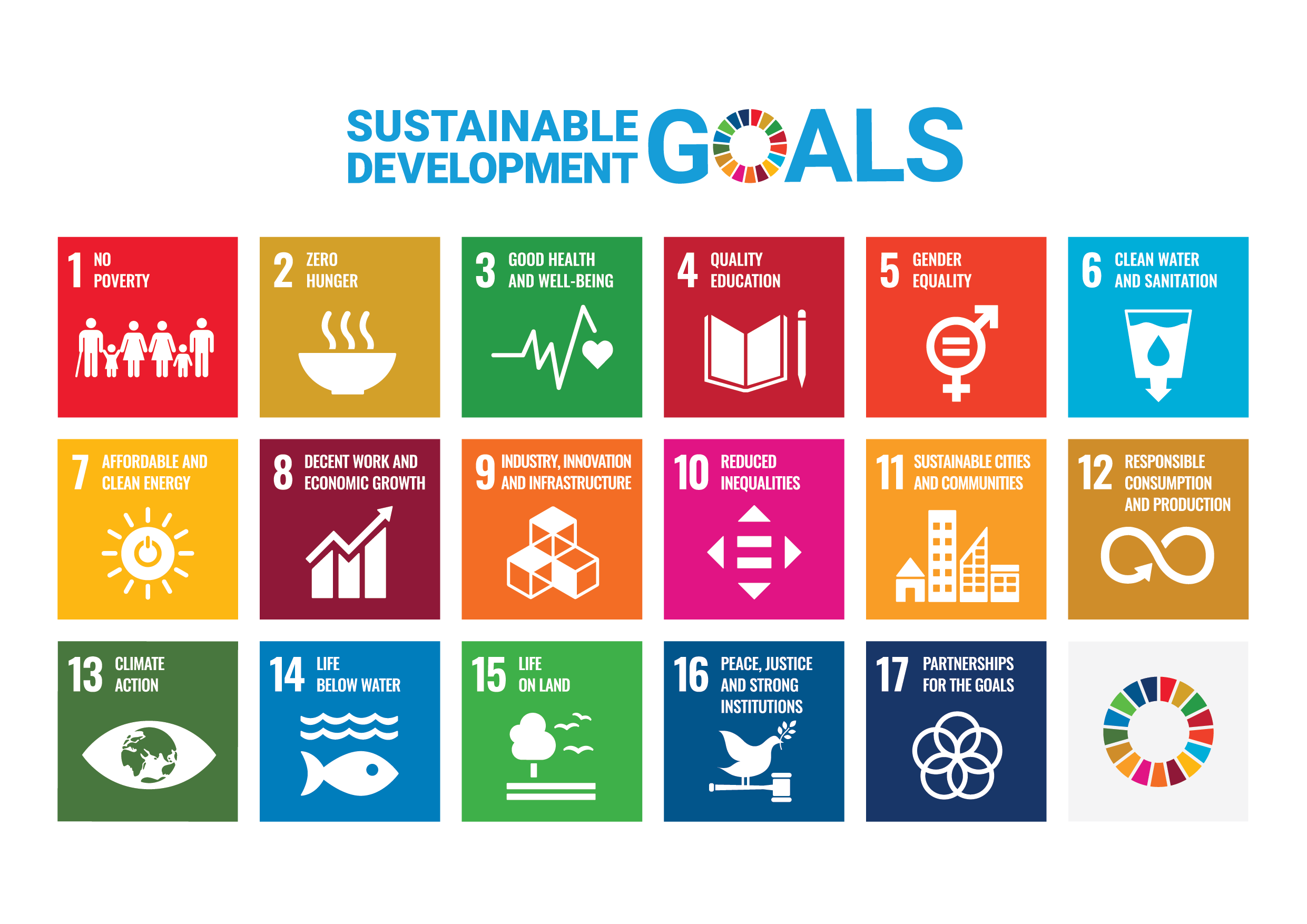

SDGs and the 2030 Agenda

ICO and the Spanish Global Compact Network (REPM), with the support of the High Commissioner for the 2030 Agenda, have launched a new web space www.icopymeods.es where small and medium-sized enterprises and the self-employed can consult all the information on the SDG as well as the business opportunities that their commitment to the 2030 Agenda can bring them.

Visit the new web