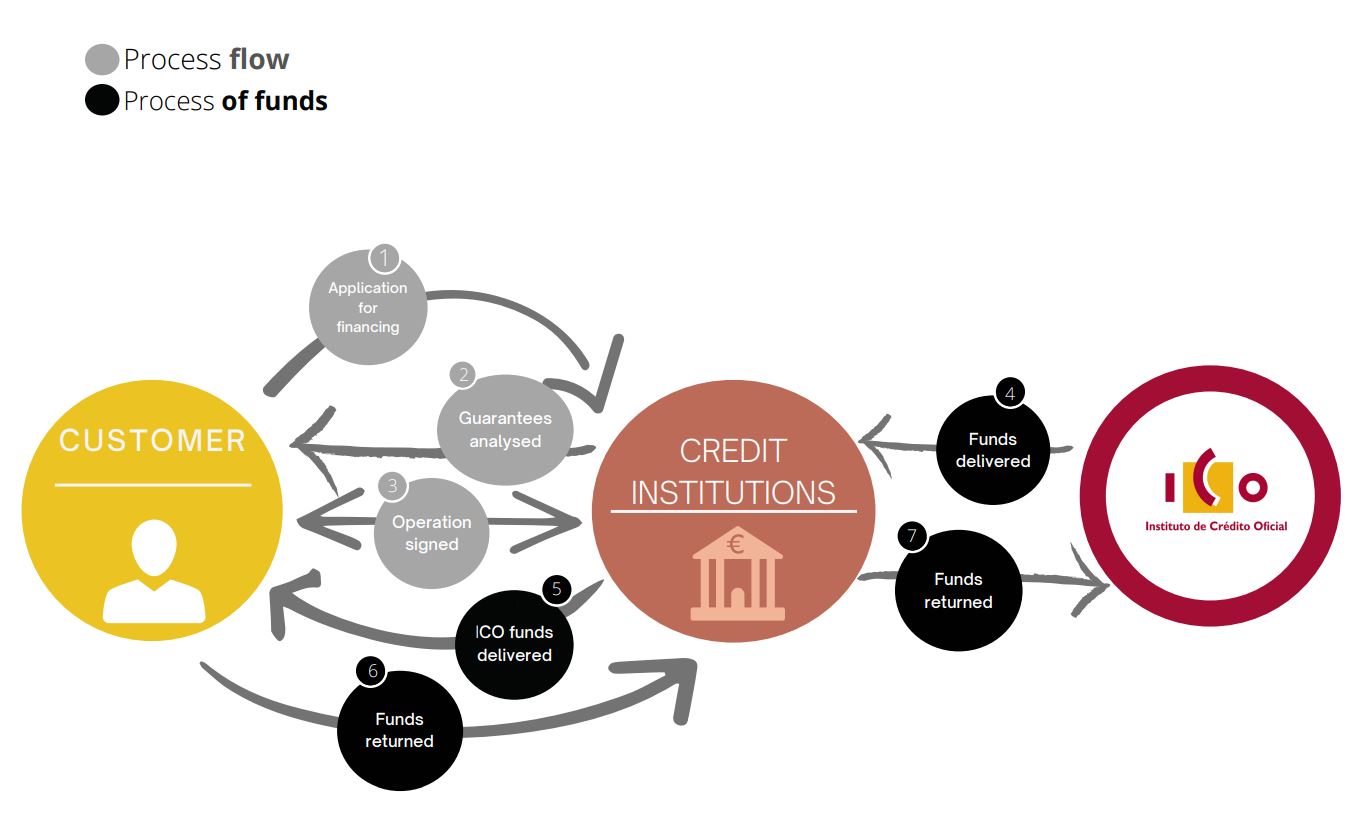

How do ICO Second Floor Facilities work?

ICO Second-Floor Facilities work through the mediation of credit institutions

They are lines of financing with which ICO provides funds, with intermediation from credit institutions.

It doesn’t matter whether your business is large or small, or which sector you are engaged in, or if you want to operate in Spain or another part of the world. There is an ICO Facility for every business person, self-employed person, entrepreneur or business. What’s important is that ICO Facilities can finance your short-, medium- or long-term activities, for any type of investment, under competitive conditions.

ICO helps you to finance your business, projects, objectives and goals, in 3 simple steps.

The process is very simple!

- Step 1: FIND OUT MORE AT ICO. See the available options on our ICO website.

- Step 2: GO TO YOUR BANK. Go to your bank branch, explain your plans, and the credit institution will asses the project.

- Step 3: APPLY FOR THE ICO FACILITY. Sign the agreement at your bank and receive the ICO financing, which will facilitate the future you are pursuing.

Credit institutions play a fundamental role: they analyse the operation, determine the required guarantees and ultimately decide whether the financing will be approved.

Once the operation is approved, the institutions formalise the corresponding agreement with their customer, with the funds that ICO delivers to the banks.

Funcionational diagram