ICO lends 150 million euros to CEPSA to install ultra-fast chargers and promote electric mobility in Spain and Portugal

18 March 2024

- ICO is granting this green loan to help finance half of this project, with investments totalling 300 million euros over the period 2023-2026

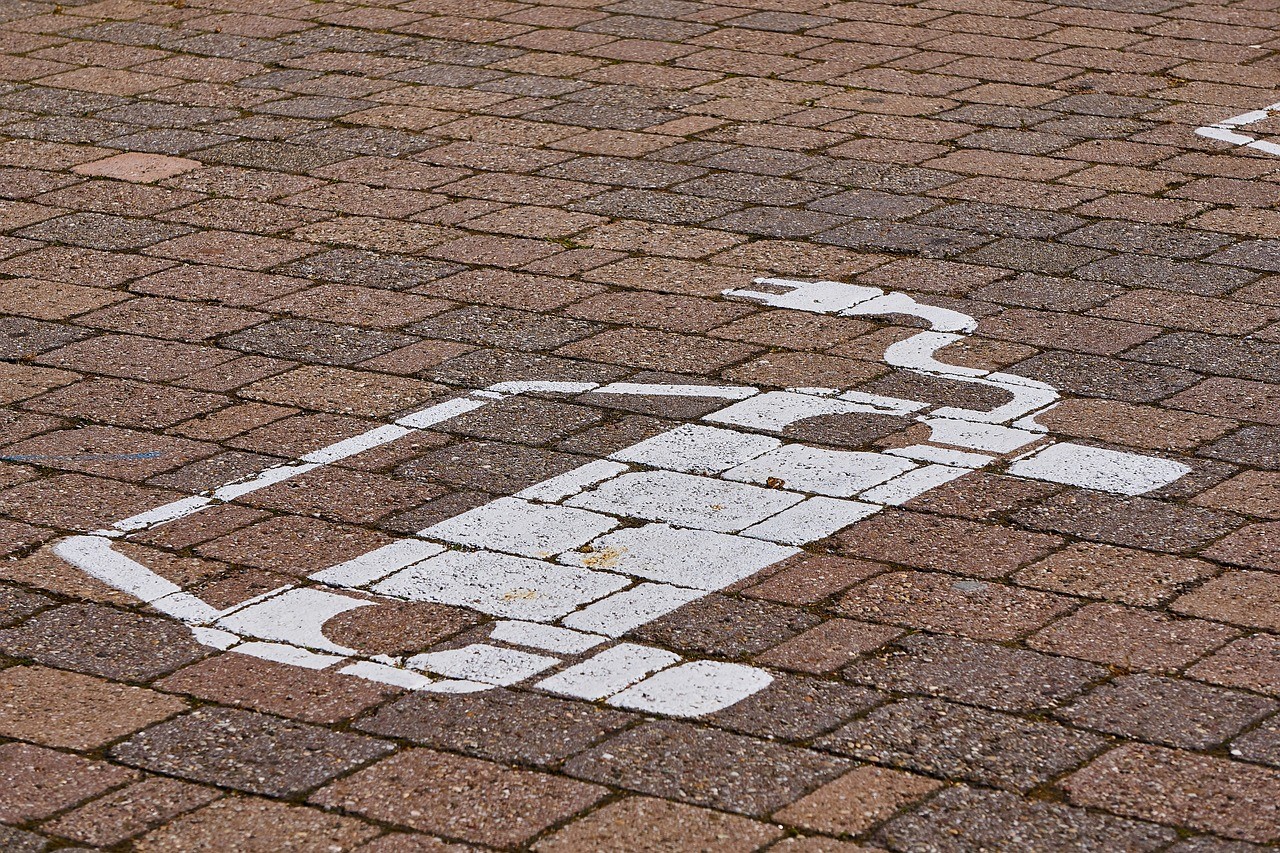

- This investment will enable CEPSA's ultra-fast charging network to provide 150kW and 300kW charging points on all major corridors and roads in Spain and Portugal

The Instituto de Crédito Oficial (ICO) has granted a green loan of 150 million euros to CEPSA to partially finance the installation of ultra-fast charging points at its service stations and promote the mobility of electric vehicles in Spain and Portugal.

In this way, the energy company is promoting the electrification and decarbonisation of road mobility, accelerating the transition to a more sustainable model, one of the objectives of the Recovery, Transformation and Resilience Plan.

During the signing ceremony, the CEO of CEPSA, Maarten Wetselaar, highlighted: "ICO's support is an incentive for us to continue developing an extensive ultra-fast charging network at our service stations in Spain and Portugal, which will boost user demand by allowing them to make intercity journeys in electric vehicles without delaying their journey due to charging time. At CEPSA, we are committed to ultra-fast charging to make electric mobility a reality”.

ICO Chairman José Carlos García de Quevedo said: "This transaction is part of the ICO's strategy to prioritise financing for projects that have a positive social and environmental impact, in line with the objectives of the Recovery Plan. The loan granted to CEPSA is a new step in this direction, supporting sustainable mobility and the creation of infrastructures accessible to all citizens".

ICO's funds will enable CEPSA’s ultra-fast charging network to provide 150kW and 300kW charging points on all major corridors and roads in Spain and Portugal. The company currently has more than 130 ultra-fast charging points installed and is developing a further 330, with the aim of offering this type of charger at most of its service stations by 2030.

The transaction signed today qualifies as a "green loan" under the Green Loan Principles (GLP) of the LMA (Loan Market Association). This loan is in addition to the 150 million euros in financing granted by the European Investment Bank (EIB) at the end of 2023, which will enable CEPSA to carry out an estimated 300 million euros in investments over the period 2023-2026.

CEPSA

Through its "Positive Motion" 2030 strategy, CEPSA is undertaking a profound transformation to decarbonise its operations and help its customers tackle their own decarbonisation challenges, focusing on electric mobility and the production of green molecules, mainly green hydrogen and biofuels.

CEPSA also aims to go beyond net-zero emissions to become a net-positive company, enabling its customers and society to move forward in a sustainable way. The company has set out an ambitious roadmap to reduce its emissions, making it one of the leading companies in its sector. Specifically, by 2030 it will reduce its Scope 1 and 2 CO2 emissions by 55% compared to 2019, and aims to achieve net zero emissions by 2050. The carbon intensity of the energy products it sells will be15-20% lower in 2030 compared to 2019.

ICO

The Instituto de Crédito Oficial (ICO) has made sustainability a horizontal principle of its operations and focuses much of its activity on the promotion of sustainable projects, both from a social and environmental point of view. In 2023, ICO participated in operations that will mobilise an investment of 16.314 billion euros in environmental and social projects.

The approval of the Addendum to the Recovery Plan marks a new milestone in the ICO Group's activity, as it has been entrusted with managing 40 billion euros in loans under the second phase of the Recovery Plan, which will help Spanish companies complete their transformation process and develop projects that promote the green and digital transition.