Últimes notícies portal ICO

-

Pla de Recuperació

Préstecs Next Generation EU per impulsar el creixement i resiliència de les empreses:

Línia ICO MRR Verd

Línia ICO MRR Empreses i Emprenedors -

Línies d’Avals

Gestionades per l'ICO per garantir el finançament d’autònoms, pimes i empreses i adquisició de primer habitatge per a joves i famílies amb menors a càrrec

-

Les nostres prioritats

Contribuir a impulsar la sostenibilitat, la transformació digital i el creixement de les empreses

ICO Crecimiento

Es la primera herramienta de financiación directa 100% digital del ICO para pymes españolas. Financia con ICO Crecimiento la actividad empresarial y la inversión de tu pyme para crecer y expandirte.

Préstamos DANA

Ya disponibles

Línea de Avales para adquisición de primera vivienda de jóvenes y familias con menores a cargo

Consulta la información

Pla de Recuperació Transformació i Resiliència

Préstecs Next Generation EU gestionats per l'Institut de Crèdit Oficial

Finançament disponible per als teus projectes

Selecciona la Línia ICO que més s’adapti a les teves necessitats. Fes el pas!

-

Línies ICO Nacional

Per finançar les teves activitats empresarials i projectes d’inversió relacionats amb l’activitat a Espanya.

-

Línies ICO Internacional

Per internacionalitzar la teva empresa o finançar la teva activitat exportadora.

T’ajudem?

- En tan sols 30 segons i dos senzills passos

- Compara les diferents solucions que tenim per a tu

- Sigui com sigui el teu projecte, tenim una solució a mida

Som l’Institut de Crèdit Oficial

L’ICO treballa per promoure activitats econòmiques que contribueixin al creixement, la generació d'ocupació i millora de la distribució de la riquesa

L’ICO en xifres

-

9.420 milions €finançament empresarial 2020-2021

-

3.632 milions €Internacionalització 2020-2021

-

5.550 milions €bons socials i verds

-

4.570 milions €per a projectes sostenibles 2020-2021

Grup ICO, coneix-lo completament

-

AXIS

Axis és una gestora de Capital de risc participada al 100 % per l’Institut de Crèdit Oficial, que posa instruments de capital a disposició de les empreses

-

La Fundació ICO

La Fundació ICO és una fundació pública estatal amb caràcter permanent i finalitat no lucrativa que desenvolupa la seva activitat amb patrimoni autònom.

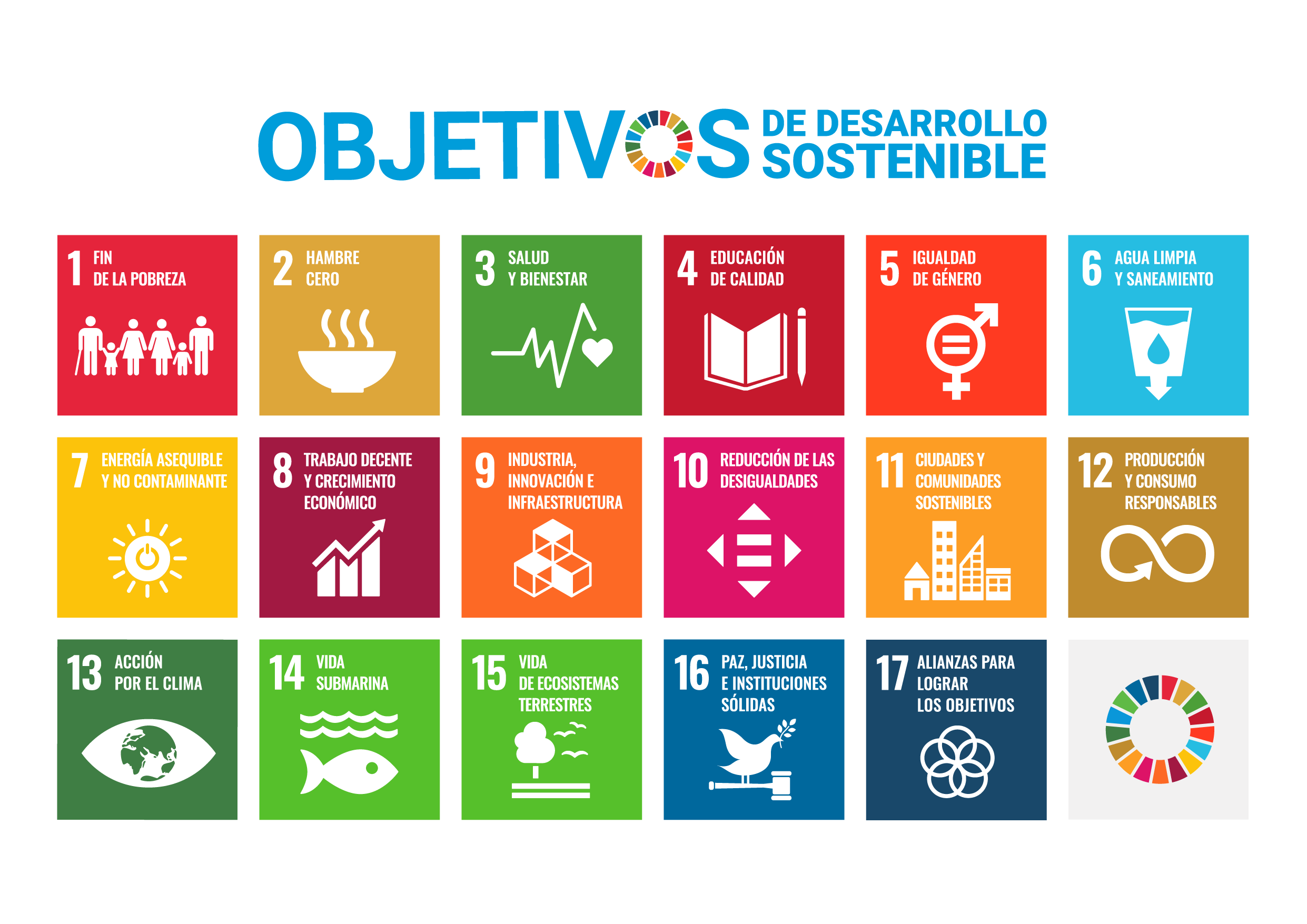

Coneix els ODS i l’Agenda 2030

No et quedis enrere en la major transformació empresarial